The borrowing discipline the State applies only when the World Bank forces it

For the first time, the Union Government has placed on the floor of Parliament the full scale of Maharashtra’s dependence on foreign loans. World Bank, ADB, AIIB, NDB, IFAD — the entire borrowing architecture is now officially on record.

X: @vivekbhavsar

Mumbai: What the Centre has admitted in writing matches exactly what TheNews21 has been exposing for months.

But even as Delhi accepts the numbers, the State Government’s explanation collapses on one sharp question that still has no answer.

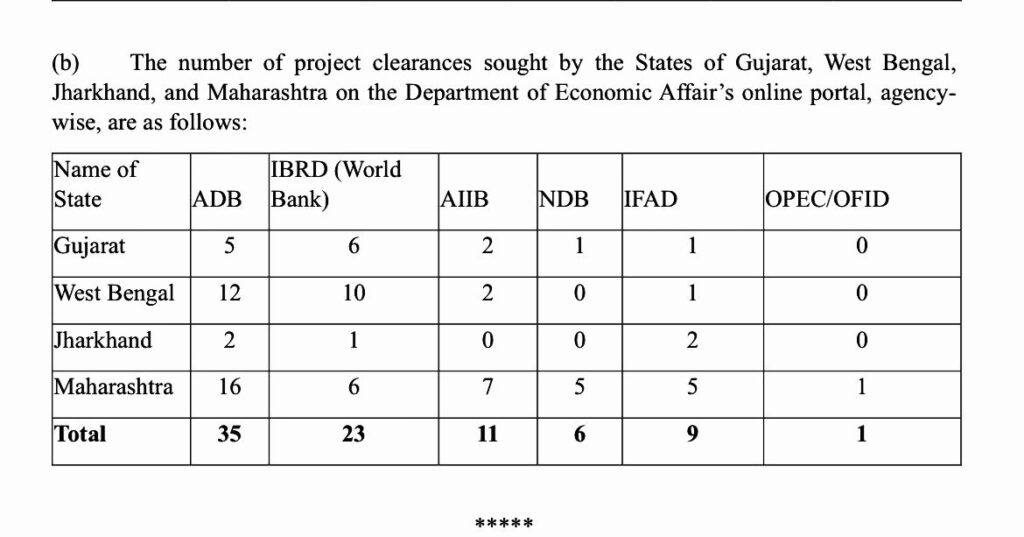

Parliament Puts It on Record: Maharashtra Tops India in Multilateral Borrowings

In a written reply in the Lok Sabha (Unstarred Q.48, December 1, 2025), the Union Finance Ministry disclosed that Maharashtra has the largest foreign loan portfolio in the country — running across 33 World Bank projects, 14 ADB projects, 4 AIIB projects, 2 NDB projects and 5 IFAD projects.

The figures speak for themselves:

- World Bank (IBRD/IDA): USD 6427.4 million (~ ₹53,347 crore)

- ADB: USD 3635.84 million (~ ₹30,177 crore)

- AIIB: USD 1885 million (~ ₹15,646 crore)

- NDB: USD 501 million (~ ₹4,158 crore)

- IFAD: USD 224.76 million (~ ₹1,866 crore)

Total external exposure: ₹1,05,194 crore (≈ ₹1.05 lakh crore).

(At a conservative exchange rate of ₹83 per USD.)

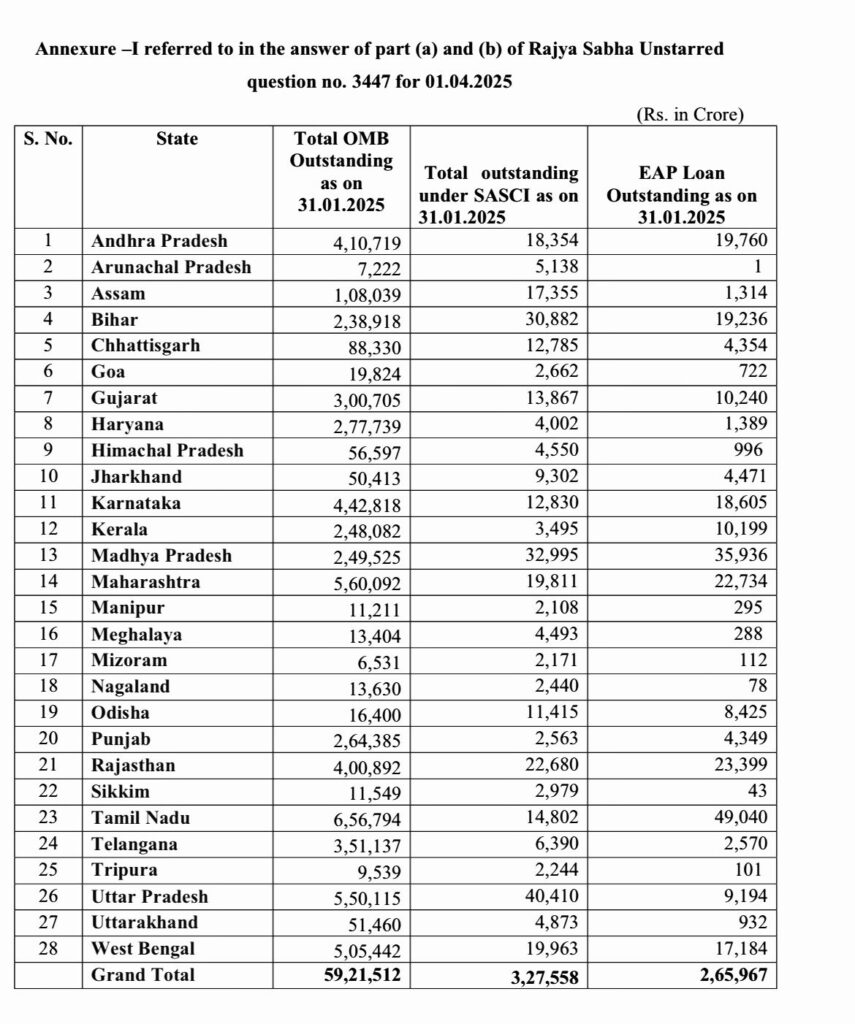

A separate reply in the Rajya Sabha puts Maharashtra’s outstanding EAP (Externally Aided Project) debt at ₹22,734 crore, corroborating the numbers obtained by TheNews21 through RTI.

This is no longer analysis.

This is now official Parliament record.

State’s Economic Advisor Defends the Foreign Borrowings

After these disclosures became public, TheNews21 received a suo motu clarification from Pravin Pardeshi, CEO of MITRA and Chief Economic Advisor to CM Devendra Fadnavis.

According to Mr Pardeshi, Maharashtra turns to World Bank and ADB loans because Open Market Borrowings (OMB) get consumed by routine expenditure:

“Open market borrowing goes into salaries, pensions, subsidies, drought relief, calamities, interest payments and Pay Commission revisions. These are unavoidable.

World Bank, ADB and AIIB loans can only be used for asset creation and institution building. They directly increase GDP and reduce poverty.”

He added that the State has already exhausted domestic borrowing routes for capital works:

“We have arranged ₹15,000 crore from NABARD for irrigation and ₹15,000 crore from domestic banks for infrastructure like the Samruddhi Highway. Domestic borrowing for investment is fully leveraged. Multilateral loans fill that gap.”

But TheNews21’s Question Still Remains — And It Has Not Been Answered

Mr Pardeshi explains why Maharashtra uses foreign loans.

But he avoids the core issue raised by this investigation:

If World Bank loans can be strictly ring-fenced for specific projects, why can’t Maharashtra enforce the same financial discipline on loans taken from Indian banks?

This single question exposes the larger contradiction in the State’s borrowing model.

Three Contradictions the State Cannot Ignore

1. The State claims domestic borrowings get diverted to salaries and subsidies.

Diversion does not happen automatically. It happens because the government chooses not to ring-fence domestic loans.

2. Ring-fencing is not a foreign idea — it is a budgeting discipline.

You can assign cost centres, create escrow accounts, verify end-use and restrict diversion.

Nothing stops Maharashtra from applying the same discipline to NABARD or Indian Bank loans.

3. If discipline is possible only when the World Bank demands it, what does that say about Maharashtra’s own fiscal governance?

This question remains untouched.

Is This Dependence or a Lack of Discipline?

If Maharashtra enforced its own ring-fencing, transparency and utilisation rules for domestic loans:

- The State could build capital assets without foreign currency risk

- Lifetime project costs would not escalate by 30–60%

- No commitment charges would bleed money on unspent balances

- External agencies would not be required to police utilisation

But what the government has normalised is the opposite:

- Domestic loans are “flexible” — and therefore diverted

- World Bank loans are “disciplined” — because someone else enforces the rules

That is not a financial compulsion.

That is an administrative choice — and an expensive one.

Parliament Has Spoken. Experts Have Spoken. But the Fundamental Question Stands.

TheNews21’s investigation has now reached three tiers:

Documentary evidence: Annexures, RTI replies,

Political acknowledgement: Parliament

Expert defence: State’s economic advisor

But what remains unanswered is the heart of the matter:

Why must Maharashtra outsource financial discipline to the World Bank?

Why can’t the State impose the same discipline on domestic loan and escape the long-term foreign debt trap?

Until this question is answered, the debate is not about numbers anymore.

It is about governance, control and fiscal responsibility.

This is no longer merely a financial story.

It is a governance story.

Also Read: Maharashtra’s World Bank Loan Trap: Hidden Costs Bleeding the State

Also Read: Maharashtra’s World Bank Loan Trap: The True Cost of Borrowing

Also Read: Maharashtra’s World Bank Loan Trap: Case Studies of Costly Projects

Also Read: Maharashtra’s World Bank Loan Trap: The Escalation Over Two Decades

Also Read: Maharashtra’s World Bank Loan Trap: Policy Questions & The Way Forward

Also Read: Maharashtra’s World Bank Loan Trap: “Climate Project or Cash Drain?”

Also Read: Maharashtra’s World Bank Loan Trap: Paying for Nothing

Also Read: Maharashtra’s World Bank Loan Trap: The All-In Cost

Also Read: Maharashtra’s World Bank Loan Trap: The Fine Print That Bled the State

Also Read: Maharashtra’s World Bank Loan Trap: What Delhi Admitted

Also Read: Maharashtra’s World Bank Loan Trap – Debt Dressed as Development

Also Read: Maharashtra’s World Bank Loan Trap –The Politics of Accountability

Cả nhà ơi OK9 đang hot lắm, chơi vui mà còn có sự kiện thưởng lớn nữa. Tải app tại Ok9bet.net

https://www.video.ru.com/ đúng nghĩa là nền tảng cá cược trực tuyến uy tín. Tốc độ nạp rút nhanh, kèo ổn định và hỗ trợ 24/7 nên chơi lâu dài rất an tâm.

Yo peeps, 88clbgame is where it’s at! Loads of different games to keep you busy. I especially liked the selection they got. Hit them up here 88clbgame!

An fascinating dialogue is worth comment. I believe that it is best to write extra on this matter, it won’t be a taboo subject but generally individuals are not enough to speak on such topics. To the next. Cheers

Das Beschwerdeteam hatte sie darüber informiert, dass die Bearbeitungszeit für Auszahlungen aufgrund der KYC-Verifizierung oder eines hohen Antragsaufkommens

länger dauern könnte. Durchsuchen Sie alle von Mr. O

Casino angebotenen Boni, einschließlich jener Bonusangebote, bei denen Sie keine Einzahlung vornehmen müssen, und durchstöbern Sie auch alle Willkommensboni, die Sie bei

Ihrer ersten Einzahlung erhalten werden. Aus diesem Grund empfehlen wir Ihnen, ein Casino mit fairen Spielregeln zu suchen, das

zumindest die Allgemeinen Geschäftsbedingungen einhält, wenn Sie sich dazu entscheiden sollten, an den bestimmten Boni und Promotionen des Casinos teilzunehmen.

Neue Spieler im Mro Casino können sich über

einen attraktiven Willkommensbonus freuen, der sowohl Bonusgeld als auch Freispiele umfasst.

Das Casino bietet eine breite Palette an Spielen, von klassischen Slots bis hin zu Live-Casinospielen, die von führenden Softwareanbietern der Branche bereitgestellt werden.

Dank der gültigen Lizenz und der hohen Sicherheitsstandards können Spieler hier bedenkenlos spielen. Das Mro Casino bietet eine

moderne und benutzerfreundliche Plattform, die sowohl auf dem Desktop als auch auf mobilen Geräten überzeugt.

References:

https://online-spielhallen.de/der-legiano-casino-login-ihr-weg-zum-online-glucksspiel/

They may not move any other checkers until that knocked

off checker is returned. If you roll doubles, you get to move each die twice, concluding in four moves for that turn. Highlights show you where the checkers can possibly move.

247 Backgammon has games in five difficulites,

ranging from easy to expert! Play with an artificially intellegent opponent or play

with a friend with Pass & Play! Our platform is continuously updated with new features and improvements based on player feedback.

Please update to the latest version to continue playing

our multiplayer games 😎. Dedicating some time to playing backgammon can improve your logical thinking and reasoning skills.

If your opponent moves your tile to this place, then you cannot move any other checker until the removed checker

is brought back into play. The player with the highest score goes first and begins

to move their checkers around the board. If only one of your opponent’s checkers is placed here,

landing on the closed point means you can remove

their checker from the board. Despite its long history, Backgammon remains a popular game in 2024, with

millions of online and offline players competing every day.

References:

https://blackcoin.co/best-payid-casinos-in-australia-15-sites-that-accept-payid/

Being a relatively new platform, it’s likely that the live casino library will grow over time.

These games are straightforward, quick to play, and offer the chance to score impressive winnings.

Jackpot pokies are conveniently placed in their own section, making it easy for high-stakes players to chase life-changing wins.

Unsurprisingly, online pokies take center stage in the game library.

The homepage doubles as an intuitive gaming lobby where you can sort games by category

or search by name or provider, helping you find your favorites in no time.

If not, check the promo page or ask support before playing — bonuses often can’t be activated retroactively.

The mobile version of sky crown online casino runs smoothly

on both Android and iOS — no app download required,

just log in through your browser and you’re good to go. Skycrown Casino Australia real money

players get access to one of the most stacked game libraries around.

There’s also a unique crypto bonus for players using Bitcoin, Ethereum, or other coins — which

makes the casino stand out if you like playing with crypto.

References:

https://blackcoin.co/6_vip-casino-review-2022-special-bonuses-for-canadians_rewrite_1/

online slots uk paypal

References:

https://finbullish.com/companies/mejores-casinos-online-con-dinero-real-en-usa-top-2025/

online pokies australia paypal

References:

spechrom.com

What i do not understood is in fact how you’re not really much more well-favored than you might be now. You are very intelligent. You already know thus significantly with regards to this topic, made me individually imagine it from so many varied angles. Its like women and men aren’t fascinated except it is one thing to accomplish with Woman gaga! Your individual stuffs great. Always care for it up!

Spot on with this write-up, I truly assume this website wants far more consideration. I’ll in all probability be again to read rather more, thanks for that info.

A person essentially help to make seriously articles I would state. This is the very first time I frequented your website page and thus far? I amazed with the research you made to create this particular publish extraordinary. Fantastic job!

You are a very clever individual!