Despite NABARD, PSU banks, and bond markets offering cheaper credit, successive governments chose World Bank loans. Officials cite “global expertise,” but our RTI data shows this comes at a steep and unsustainable price.

X: @vivekbhavsar

Part 5 – Policy Questions & Conclusion

The numbers leave little room for doubt. Maharashtra’s experience with World Bank loans is not an exception but a warning. While some projects have delivered benefits, the long-term financial burden has been far heavier than advertised. This raises urgent policy questions that governments can no longer ignore.

Why Are Alternatives Ignored?

India today has a mature domestic borrowing ecosystem. Nationalised banks, NABARD, and even the bond market routinely offer loans at competitive rates. Unlike World Bank loans, domestic borrowing carries no foreign exchange risk and no commitment charges on undisbursed funds.

Also Read: Maharashtra’s World Bank Loan Trap: Hidden Costs Bleeding the State

Yet, successive governments in Maharashtra — across party lines — have preferred World Bank loans. Why? Officials argue that multilateral loans bring “global expertise” or “credibility.” But as our RTI data reveals, that so-called expertise comes at a steep and unsustainable price.

The Centre’s Role

All World Bank loans are first contracted by the Union Government and then on-lent to states. This raises two systemic concerns:

1. Lack of Transparency – State legislatures rarely see the full picture of interest, fees, and forex risks.

2. Cost Pass-Through – The Centre passes on liabilities without conducting a comparative analysis with domestic financing options.

Also Read: Maharashtra’s World Bank Loan Trap: The True Cost of Borrowing

If the Ministry of Finance does not disclose the “all-in cost” of these loans, how can states make truly informed financial choices?

Lessons from Maharashtra

Our RTI-based investigation shows that:

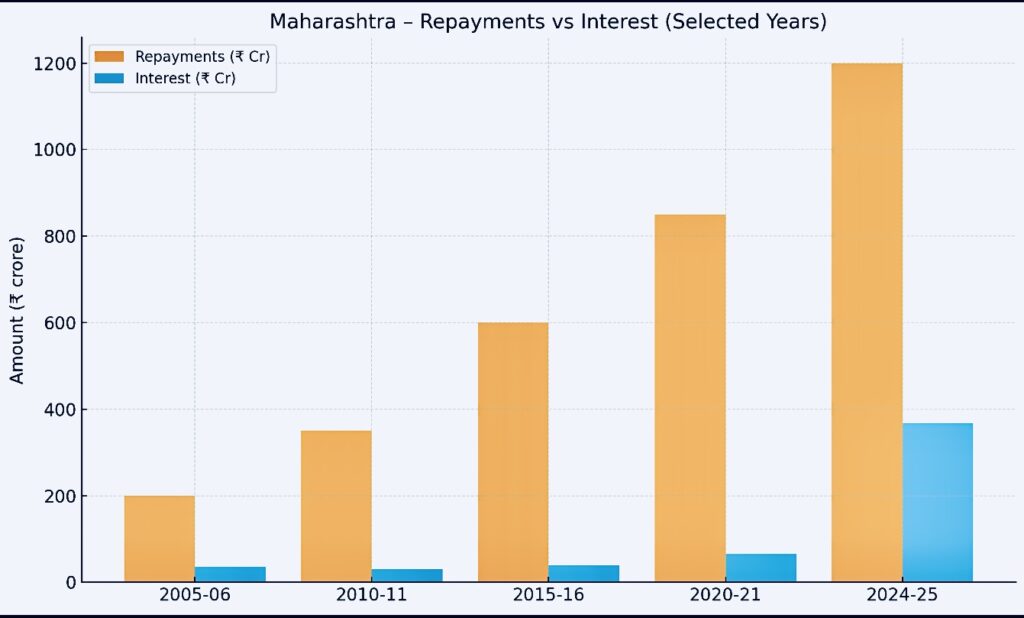

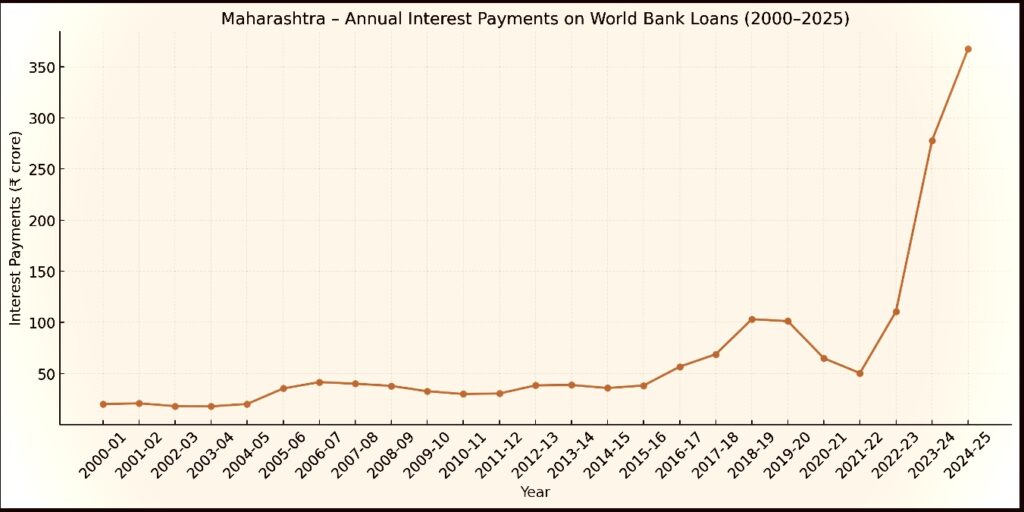

• Repayments alone do not reflect the true cost.

• Interest and commitment charges inflate project costs by 40–60%.

• Maharashtra today is paying more in annual interest on just one or two projects than it did on its entire loan portfolio in the 2000s.

This is neither sustainable nor justifiable.

The Way Forward

1. Mandatory Cost Comparison – Each multilateral loan must be benchmarked against NABARD, PSU banks, and state bond options.

2. Legislative Oversight – Assemblies must debate and approve “all-in cost” projections before loans are contracted.

3. Transparency in Reporting – Interest and commitment charges must appear upfront in budget documents, not hidden in annexures.

4. Shift to Domestic Sources – Maharashtra should prioritise NABARD, PSU banks, and development bonds — cheaper credit, no hidden traps.

World Bank loans were meant to build resilience. Instead, they have trapped Maharashtra in a cycle of repayments and interest that diverts funds away from development. Unless borrowing patterns change, taxpayers will remain the losers while international lenders profit.

Also Read: Maharashtra’s World Bank Loan Trap: Case Studies of Costly Projects

Editor’s Note

This is not the conclusion of our investigation. At TheNews21, we will continue this series with deeper analysis and expert voices. Expect insights from policymakers, former chief ministers, retired finance officials, global economists, and even the World Bank itself.

And that’s not all — in Part VI, we will publish a project-wise analysis based on official annexures from 2000 to 2026, exposing which loans drained Maharashtra’s coffers the most in interest payments. For the first time, readers will see the names, sanction years, and financial burden of each project in black and white.

Also Read: Maharashtra’s World Bank Loan Trap: The Escalation Over Two Decades

The numbers have spoken. Now, it’s time to hear from those who shaped, defended, or questioned these decisions. Our investigation will continue until the full truth of Maharashtra’s World Bank loans — their hidden costs and long-term impact — is laid bare.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

It is truly a great and useful piece of info. I am satisfied that you shared this useful information with us. Please keep us informed like this. Thanks for sharing.