GOLD futures drop by ₹590; SILVER up by ₹733; CRUDEOIL down by ₹67; MCXBULLDEX hits 22,016

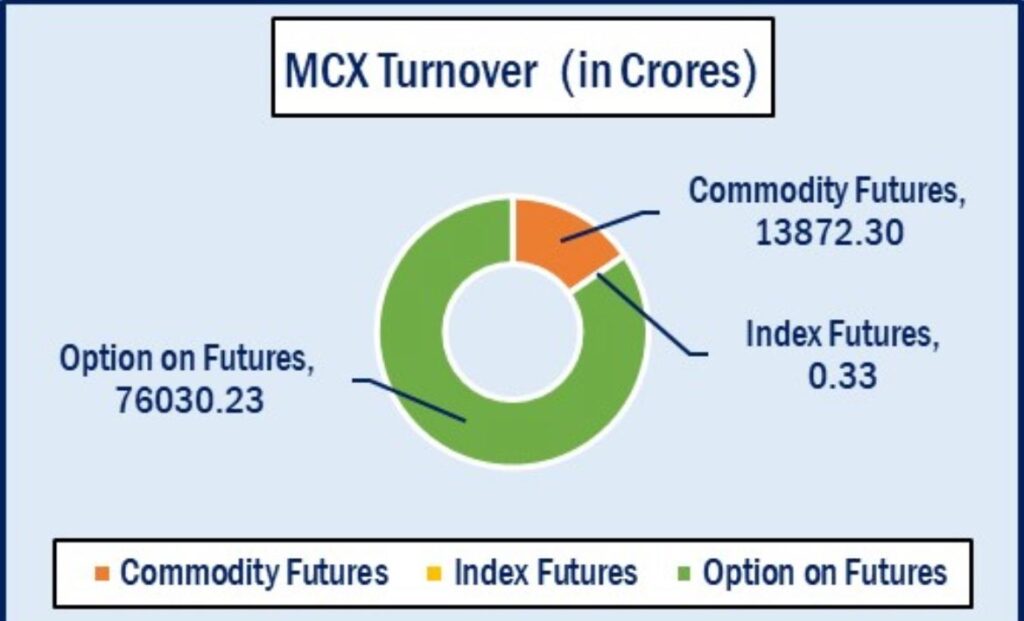

Mumbai : India’s premier commodity derivatives exchange, Multi Commodity Exchange (MCX), recorded a total turnover of ₹89,902.87 crore across commodity futures, options, and index futures contracts till 4:30 PM today. This includes ₹13,872.3 crore from commodity futures and ₹76,030.23 crore (notional) from options on futures. The MCX Bullion Index (MCXBULLDEX) May 2025 futures contract was trading at 22,016.

Commodity Futures Turnover:

Bullion:

Gold and Silver futures combined posted a turnover of ₹12,127.27 crore.

• Gold (June-2025): Down ₹590 or 0.61% at ₹95,435 per 10g

• Gold Ten (April-2025): Up ₹625 or 0.66% at ₹95,550 per 10g

• Gold Guinea (April-2025): Up ₹140 or 0.18% at ₹76,700 per 8g

• Gold Petal (April-2025): Down ₹132 or 1.35% at ₹9,634 per g

• Gold Mini (May-2025): Down ₹659 or 0.69% at ₹95,500 per 10g

• Silver (May-2025): Up ₹733 or 0.76% at ₹97,197 per kg

• Silver Mini (April-2025): Up ₹751 or 0.78% at ₹97,170 per kg

• Silver Micro (April-2025): Up ₹846 or 0.88% at ₹97,093 per kg

Gold futures recorded ₹5,636.54 crore in turnover (5,906 lots), while Silver stood at ₹2,592.72 crore (8,863 lots).

Base Metals:

Total turnover in base metals stood at ₹1,000.49 crore.

• Copper (April-2025): Up ₹5.95 or 0.7% at ₹852.8/kg

• Zinc (April-2025): Up ₹2.8 or 1.13% at ₹250.2/kg

• Aluminium (April-2025): Up ₹1.9 or 0.82% at ₹233.4/kg

• Lead (May-2025): Up ₹0.45 or 0.25% at ₹178.2/kg

Turnovers: Copper – ₹653.39 cr, Aluminium – ₹93.03 cr, Lead – ₹15.3 cr, Zinc – ₹148.03 cr.

Energy:

Turnover in energy futures stood at ₹1,005.37 crore.

• Crude Oil (May-2025): Down ₹67 or 1.27% at ₹5,214/BBL

• Natural Gas (May-2025): Down ₹3 or 1.05% at ₹283/MMBTU

Crude oil futures posted a turnover of ₹350.43 crore, while natural gas posted ₹489.89 crore.

Agri Commodities:

• Mentha Oil (April-2025): Up ₹7.5 or 0.83% at ₹916/kg

• Cotton Candy (May-2025): Down ₹500 or 0.9% at ₹54,800 per candy

Options on Commodity Futures:

Total notional turnover stood at ₹76,030.23 crore, with premium turnover of ₹718.4 crore.

Crude Oil Options:

• Call Option (May, ₹5300 strike): Down ₹27.4 or 14.71% at ₹158.90 (Vol: 26,674 lots)

• Put Option (May, ₹5200 strike): Up ₹34.9 or 21.46% at ₹197.5 (Vol: 33,267 lots)

Natural Gas Options:

• Call Option (May, ₹300 strike): Down ₹1.1 or 7.43% at ₹13.70 (Vol: 4,429 lots)

• Put Option (May, ₹280 strike): Up ₹1.05 or 5.98% at ₹18.6 (Vol: 5,240 lots)

Gold Options:

• Call Option (April, ₹96,000 strike): Down ₹357 or 59.55% at ₹242.5 (Vol: 7,400 lots)

• Put Option (April, ₹95,000 strike): Up ₹60.5 or 25.26% at ₹300 (Vol: 7,385 lots)

Silver Options:

• Call Option (June, ₹98,000 strike): Up ₹409.5 or 11.9% at ₹3,850 (Vol: 284 lots)

• Put Option (June, ₹95,000 strike): Down ₹168.5 or 7.33% at ₹2,130 (Vol: 156 lots)

where can i get clomiphene pill clomid for men how can i get clomiphene tablets can i order clomiphene online can i get clomid prices clomid brand name clomiphene without insurance

This is the tolerant of advise I recoup helpful.

This is a keynote which is forthcoming to my heart… Many thanks! Quite where can I lay one’s hands on the phone details in the course of questions?

buy zithromax 250mg – buy flagyl pills for sale flagyl 200mg for sale

order semaglutide 14mg for sale – order periactin 4 mg pills periactin pills

buy motilium generic – cyclobenzaprine order how to get flexeril without a prescription

buy generic inderal 20mg – order generic methotrexate 10mg methotrexate 10mg over the counter

buy generic amoxiclav – https://atbioinfo.com/ buy acillin pills for sale

buy generic esomeprazole – https://anexamate.com/ nexium over the counter

buy warfarin 2mg – https://coumamide.com/ order losartan 25mg for sale

cost meloxicam 15mg – tenderness meloxicam over the counter

brand prednisone – https://apreplson.com/ deltasone online

free samples of ed pills – buy erectile dysfunction medication non prescription ed drugs

buy amoxicillin tablets – combamoxi.com amoxicillin cost

fluconazole ca – https://gpdifluca.com/# buy fluconazole 100mg without prescription

cenforce 100mg cost – cenforce 50mg us buy cenforce tablets

cialis side effects a wifeРІР‚в„ўs perspective – https://ciltadgn.com/# cialis soft tabs canadian pharmacy

order ranitidine 300mg online cheap – https://aranitidine.com/ purchase ranitidine sale

cheap cialis canada – https://strongtadafl.com/ blue sky peptide tadalafil review

This is the make of advise I recoup helpful. como tomar synthroid para engravidar de gГЄmeos

100 mg sildenafil – https://strongvpls.com/ buy viagra qatar

I am in point of fact enchant‚e ‘ to glance at this blog posts which consists of tons of of use facts, thanks object of providing such data. buy zithromax 250mg generic

The vividness in this serving is exceptional. buy levitra tablets

Thanks on putting this up. It’s understandably done. https://prohnrg.com/

The thoroughness in this piece is noteworthy. https://aranitidine.com/fr/viagra-professional-100-mg/

This is a keynote which is virtually to my fundamentals… Myriad thanks! Exactly where can I lay one’s hands on the phone details for questions? https://ondactone.com/simvastatin/

This website absolutely has all of the bumf and facts I needed to this case and didn’t comprehend who to ask.

https://doxycyclinege.com/pro/meloxicam/

This is a question which is forthcoming to my verve… Diverse thanks! Faithfully where can I upon the acquaintance details for questions? http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4271949&do=profile

forxiga medication – order dapagliflozin pills forxiga 10 mg generic

buy xenical pill – buy orlistat pills for sale orlistat 120mg price

I’ll certainly bring to skim more. http://seafishzone.com/home.php?mod=space&uid=2331462

More posts like this would bring about the blogosphere more useful. stromectol en ligne

This is the kind of scribble literary works I positively appreciate.

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

real online casinos

ohio casinos online

online gambling sites

betmgm South Dakota betmgm Georgia betmgm KY