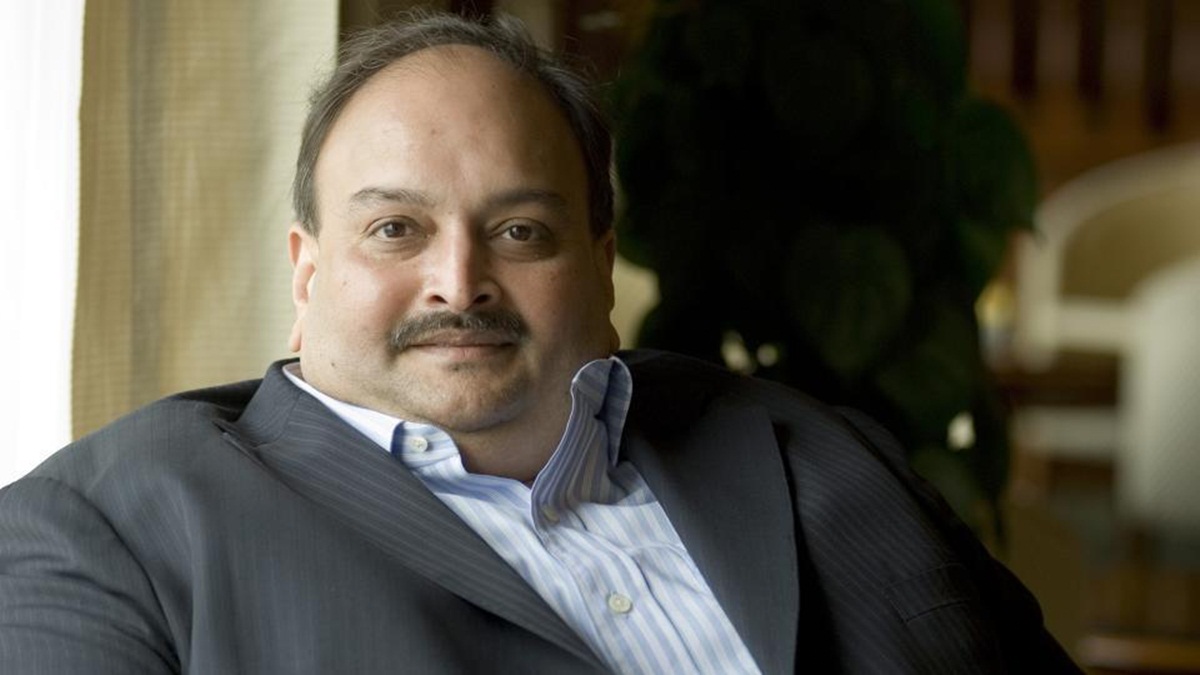

In a pivotal development in the Mehul Choksi-led Punjab National Bank (PNB) fraud case, the Enforcement Directorate (ED) has been directed by a Special Prevention of Money Laundering Act (PMLA) Court in Mumbai to monetise properties worth ₹2,565.90 crore. The move, announced on Tuesday, is intended to aid financial institutions, including PNB and ICICI Bank, in recovering substantial losses incurred due to the massive scam.

The court’s directive followed an application filed by the victim banks, supported by the ED, advocating for asset liquidation to offset the financial damage. Among the seized properties already handed over to a liquidator are high-value flats in Mumbai and factory premises in SEEPZ, Andheri (East), collectively valued at over ₹125 crore. Further transfer of attached assets is ongoing, according to ED officials.

Between 2014 and 2017, Mehul Choksi, in collaboration with associates and PNB officials, fraudulently secured Letters of Undertaking (LoUs) and Foreign Letters of Credit, causing a staggering loss of ₹6,097.63 crore to PNB. Choksi, the former promoter of Gitanjali Gems Ltd, is also accused of defaulting on loans obtained from ICICI Bank.

As part of its extensive investigation, the ED conducted searches at over 136 locations across India, leading to the attachment and seizure of assets linked to Choksi and his Gitanjali Group. These include immovable and movable assets valued at ₹1,968.15 crore, jewellery worth ₹597.75 crore, luxury properties in India and abroad, vehicles, company shares, and bank accounts.

The monetisation of these assets marks a critical step in recovering funds lost in one of India’s largest financial frauds. However, for victims and stakeholders, the process represents only a partial resolution to a case that has spotlighted systemic vulnerabilities in banking operations. The ED continues to pursue other leads in the case as Choksi remains a fugitive from Indian law.

great points altogether, you just gained a new reader. What would you suggest in regards to your post that you made some days ago? Any positive?

I gotta bookmark this web site it seems very helpful very beneficial

clomid medication cost clomid chance of twins cost of clomid pill where to buy clomid clomiphene or serophene for men can you get generic clomid for sale can you buy cheap clomiphene prices

More peace pieces like this would insinuate the web better.

I couldn’t resist commenting. Profoundly written!

order azithromycin 500mg – ciplox for sale order flagyl 400mg online

motilium 10mg over the counter – buy flexeril 15mg sale purchase flexeril online cheap

purchase amoxicillin without prescription – order ipratropium 100mcg pill purchase combivent pills

buy zithromax 250mg pills – buy bystolic 20mg online buy bystolic paypal

buy clavulanate generic – https://atbioinfo.com/ buy acillin pills for sale

nexium 20mg us – https://anexamate.com/ oral esomeprazole 40mg

purchase medex pill – coumamide cozaar 50mg oral

how to get meloxicam without a prescription – mobo sin meloxicam medication

Heya i’m for the primary time here. I found this board and I to find It really helpful & it helped me out a lot. I’m hoping to give something again and aid others like you helped me.

prednisone 40mg price – corticosteroid buy generic prednisone online

cheap erectile dysfunction pills online – best erection pills buy ed medications

order amoxil online – https://combamoxi.com/ buy generic amoxicillin online

diflucan us – fluconazole 200mg over the counter forcan where to buy

order lexapro 10mg generic – lexapro 20mg pill escitalopram buy online

cheap cenforce – buy cenforce 100mg online buy generic cenforce for sale

benefits of tadalafil over sidenafil – ciltad genesis cialis for bph insurance coverage

how to buy tadalafil online – https://strongtadafl.com/ best price cialis supper active

order ranitidine 300mg pill – https://aranitidine.com/ order zantac 300mg

buy soft viagra – viagra sale pakistan mexican viagra 100mg

The vividness in this piece is exceptional. cenforce 200 como tomar

More posts like this would force the blogosphere more useful. https://ursxdol.com/levitra-vardenafil-online/

The thoroughness in this piece is noteworthy. stromectol prix

Thanks for the sensible critique. Me and my neighbor were just preparing to do some research about this. We got a grab a book from our local library but I think I learned more from this post. I’m very glad to see such excellent info being shared freely out there.

More articles like this would frame the blogosphere richer. https://ondactone.com/simvastatin/

This is the tolerant of delivery I recoup helpful.

where can i buy tamsulosin

This is a theme which is forthcoming to my verve… Many thanks! Quite where can I upon the contact details an eye to questions? http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24582

Very good written story. It will be beneficial to anyone who employess it, as well as yours truly :). Keep up the good work – looking forward to more posts.

Some really good info , Gladiolus I discovered this. “If you find it in your heart to care for somebody else, you will have succeeded.” by Maya Angelou.

dapagliflozin 10mg pill – https://janozin.com/# dapagliflozin order online

Hello my friend! I wish to say that this post is amazing, nice written and come with approximately all significant infos. I would like to look more posts like this .

purchase orlistat generic – site order xenical 60mg generic

This is the tolerant of post I unearth helpful. http://shiftdelete.10tl.net/member.php?action=profile&uid=205574

Hmm it appears like your website ate my first comment (it was extremely long) so I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to everything. Do you have any points for first-time blog writers? I’d certainly appreciate it.

I?¦m no longer certain the place you are getting your information, however great topic. I needs to spend some time studying more or figuring out more. Thanks for fantastic information I was in search of this info for my mission.

You can keep yourself and your dearest by way of being alert when buying prescription online. Some druggist’s websites manipulate legally and sell convenience, solitariness, rate savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/prednisone.html prednisone

The thoroughness in this section is noteworthy. TerbinaPharmacy

This is the gentle of literature I rightly appreciate.

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

I love what you guys are up too. This kind of clever work and reporting! Keep up the awesome works guys I’ve added you guys to blogroll.

Usually I do not read post on blogs, but I wish to say that this write-up very pressured me to take a look at and do so! Your writing taste has been amazed me. Thank you, very great article.

Hey very cool blog!! Man .. Excellent .. Amazing .. I’ll bookmark your web site and take the feeds also…I am happy to find so many useful info here in the post, we need develop more strategies in this regard, thanks for sharing. . . . . .

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

I have read some good stuff here. Certainly worth bookmarking for revisiting. I wonder how much effort you put to create such a wonderful informative web site.

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Appreciate it for helping out, excellent information.

Hi there would you mind letting me know which webhost you’re using? I’ve loaded your blog in 3 different browsers and I must say this blog loads a lot quicker then most. Can you recommend a good web hosting provider at a honest price? Thanks, I appreciate it!

Glad to be one of many visitors on this awe inspiring website : D.

Loving the info on this internet site, you have done great job on the posts.

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…

betmgm login https://betmgm-play.com/ betmgm SC

Unlock the thrill of endless gaming adventures right at your fingertips. In crowns coins, you’ll find top-tier slots and exciting table games. Dive in and claim your welcome bonus today!

Sweet Bonanza is the ultimate treat for slot fans: colorful, volatile, and wildly rewarding. Free spins sweet bonanza tips turn small bets into huge hauls. Your sugar rush starts here!