“From thrifting and budget-friendly travel to careful investing, young Indians are rethinking money- not as a tool for display, but for steadiness, determination and control”

Money has become one of the most visible fears or anxieties of young adulthood. Between the uncertain job markets, increasing rents, and the day-to-day cost of living, GenZ is getting to know early that financial stability cannot be taken for granted.

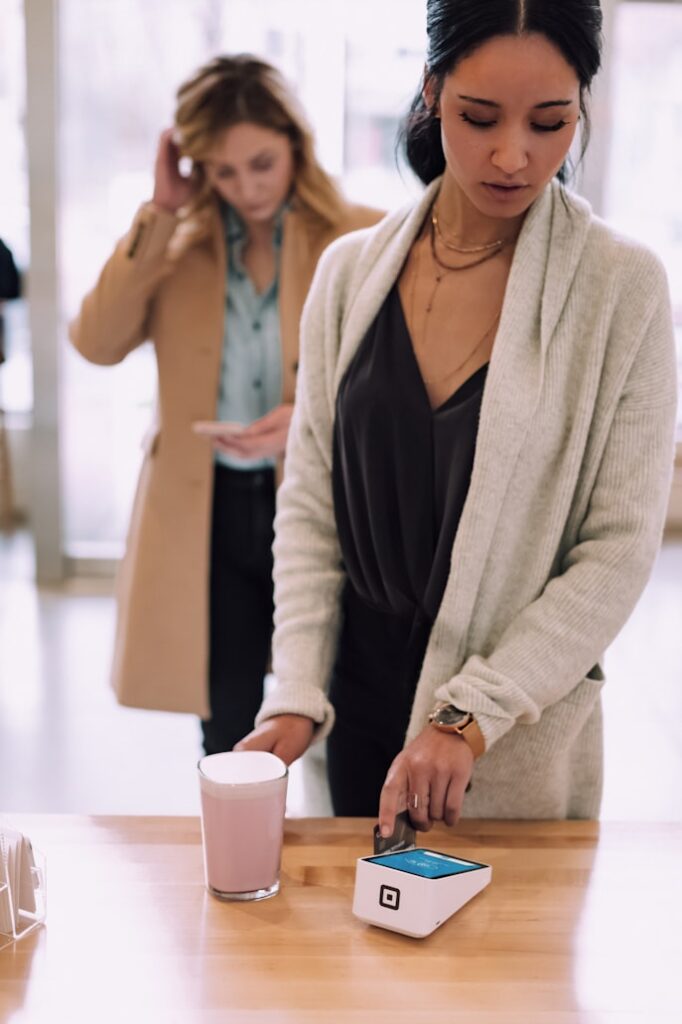

This reality is shaping how young Indians think about spending. Flex culture, once desired, now feels too risky. In its place is a silent insistence on value: money spent carefully, buffers built slowly, and choices that choose long-term comfort over short-term display.

This change is more visible in everyday habits. Thrifting has become more firmly mainstream. Platforms such as Bookchor for books, Instagram thrift stores for clothing, and exchange apps for furniture are primarily used by students and young professionals. Apart from affordability, thrift stores offer originality and sustainability- qualities that feel more significant than fast trends.

Also Read: The Rise of Soft Living Among Urban Indian Student

“I don’t feel the need to buy new things just to keep up,” says Ravtej, a young professional based in Mumbai. “Thrifting helps me save without feeling like I’m missing out.”

This does not imply that Gen Z are uniform in nature. Impulse spending, trends inspired by influencers, and luxury expectations continue to coexist with value thinking. Many young people are confused between restraint and indulgence- saving carefully in some areas while at the same time spending at some areas. What has transformed is not the absence of desire, but the increasing awareness of consequences.

This careful attitude is not only limited to shopping but also to everyday lifestyle choices.

Food and leisure choices showcase a similar mindset. Eating out less often, choosing cafes over costly nightlife, and cooking at home are increasingly framed as lifestyle choices, rather than settlements. Spending is planned, not spontaneous. Enjoyment matters, but so does peace of mind.

This cost-conscious mindset also shapes how young people perceive travel.

Travel is another area whose value has outweighed flexibility. Instead of luxurious stays and packed itineraries, GenZ is choosing budget-friendly travel- overnight trains, affordable hostels or homestays, and off-season trips. Planning is conscious, with costs tracked closely. Students often prefer to take multiple trips rather than one expensive trip. Experience matters most in travel, not proof.

A college student shared that budget travel gives her “more freedom and less guilt.” “I enjoy trips more when I’m not stressed about how much I spent.”

Digital access to financial knowledge has also transformed behaviour. Finance-related content on social media has made concepts like SIPs, emergency funds, and long-term investing feel accessible rather than intimidating. Many young earners start small, prioritising learning and stability over quick returns.

Specifically, responsible investing is gaining popularity. Many young earners prefer stability over speed, treating money less as an achievement and more as a form of protection. Growing up in between layoffs, financial awareness is increasingly viewed as a foresight rather than fear.

Ravtej explains that starting small felt safer. “I’d rather invest slowly and understand what I’m doing than chase returns. Peace of mind matters more to me than fast gains.”

Value-driven spending also showcases a cultural shift away from overconsumption. Sustainability, resilience, and ethics increasingly shape choices. Buying fewer things- but good ones- has become the principal instead of a trend.

At the same time, this does not mean that GenZ never indulges. They do- indulgence is calculated. Big purchases are scheduled, saved for, and considered emotionally as well as financially. The question is now no longer “can I afford it?” but rather “is it worth it?”

Flex culture hasn’t vanished. But it is no longer equivalent to success. For many young indians, success now is defined as flexibility- the potential to absorb setbacks, exchange paths, and love without constant financial pressure. For Gen Z, choosing value over flex is less about restraint and more about control—over time, money, and the kind of life they want to build.

**femipro**

femipro is a dietary supplement developed as a natural remedy for women facing bladder control issues and seeking to improve their urinary health.

We88slot has been treating me right! The slots are fun, and I actually walked away with some winnings. Here’s the link: we88slot

Tried out 2jl1, it’s got some unique games. Nothing crazy, but keeps you entertained. You can find it here: 2jl1

Jili17login site is straightforward and easy you know, what you see is what you get. Check them out here: jili17login

A person essentially help to make seriously articles I would state. This is the very first time I frequented your website page and thus far? I surprised with the research you made to make this particular publish amazing. Excellent job!

https://asklong.ru

https://asklong.ru

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

F*ckin’ tremendous issues here. I’m very happy to peer your post. Thanks a lot and i’m looking ahead to contact you. Will you kindly drop me a mail?