Jaipur: India’s mineral security strategy is undergoing a significant transformation, with recycling at its forefront. The Rs 1,500-crore Critical Mineral Recycling Incentive Scheme, launched in October 2025, is beginning to produce tangible results, marking a significant policy shift from reliance on imports to domestic resource recovery.

During the International Material Recycling Conference (IMRC) 2026, organised by the Material Recycling Association of India (MRAI), Dr Anupam Agnihotri, Director of JNARDDC, announced that over 70 recycling companies have registered under the scheme, and more than 10 have already received formal approvals.

“This scheme is not merely an industry incentive; it is a strategic intervention under the National Critical Mineral Mission,” Agnihotri stressed, highlighting the government’s long-term policy objectives.

**Why Recycling Matters for India**

India has officially classified 24 minerals as ‘critical,’ most of which are either entirely or heavily dependent on imports. These minerals are crucial for electric vehicles, renewable energy systems, defense manufacturing, and the semiconductor and electronics industries.

“Global supply chains are tightening, and resource nationalism is on the rise. Soon, countries may restrict not only ore exports but also scrap materials,” Agnihotri warned.

“This presents India with a limited window of five to six years to build domestic recycling capacity.”

**Incentive Structure: Policy Design**

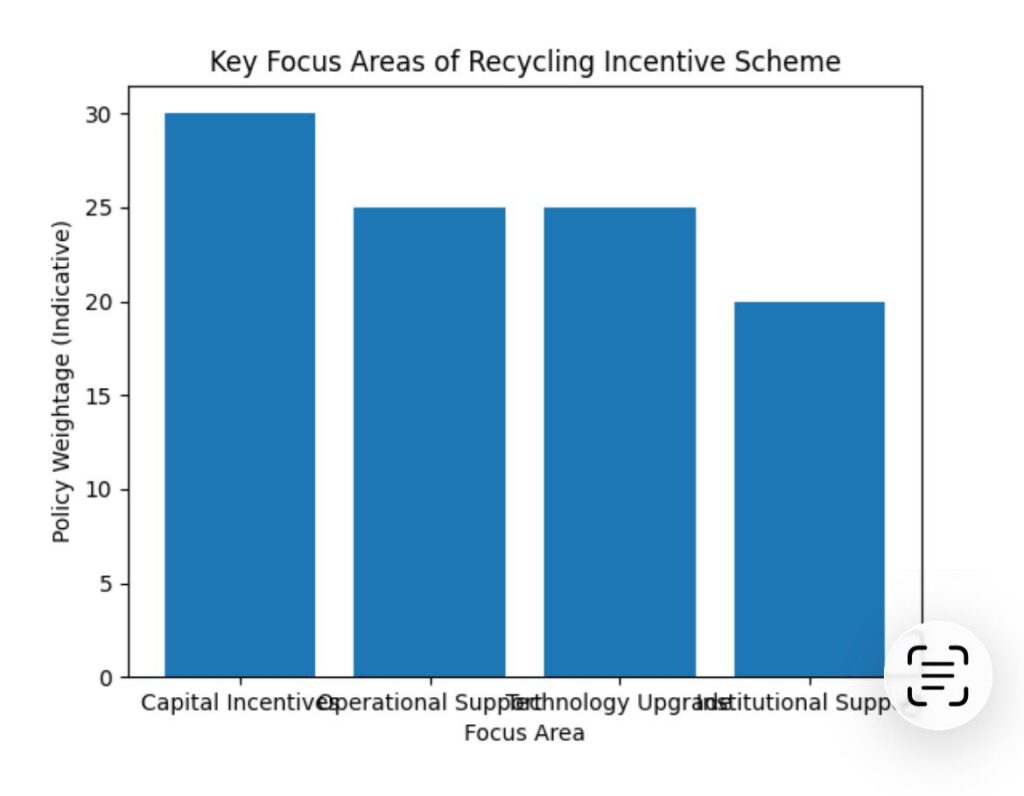

The scheme aims to establish 2.7 lakh metric tonnes of recycling capacity and follows a differentiated support model:

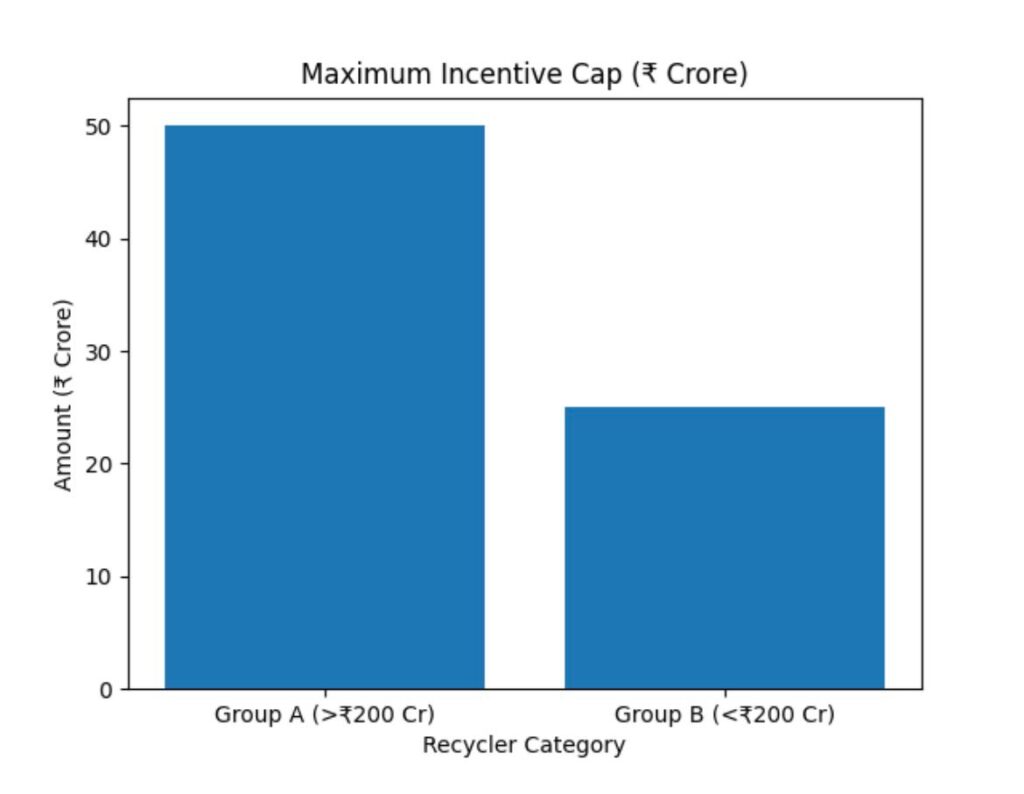

– **Group A (Turnover above Rs 200 crore)**

– Incentive up to Rs 50 crore

– Or 20% of plant and machinery costs (whichever is lower)

– **Group B (Turnover below Rs 200 crore)**

– Incentive up to Rs 25 crore

– Or 20% of plant and machinery costs

Only R3 and R4 category recyclers are eligible, ensuring that incentives are directed towards high-purity recovery operations rather than low-grade processing based on volume.

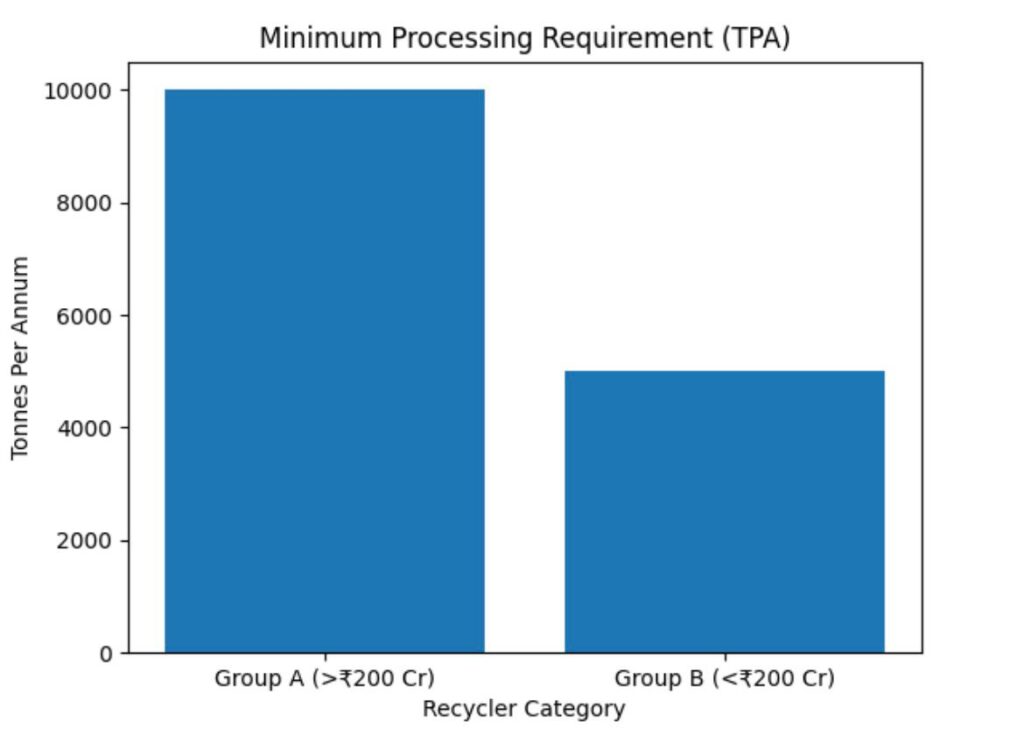

Minimum processing thresholds are set at:

– **Group A:** 10,000 tonnes per annum

– **Group B:** 5,000 tonnes per annum

Black-mass-only operations are deliberately excluded to prevent shallow value addition.

**Institutional Architecture**

JNARDDC, an autonomous body under the Ministry of Mines, has been designated as the nodal agency for recycling aluminum, copper, lead, and zinc. Its expanded mandate includes:

– Funding startups beyond TRL-3

– Supporting pilot plants

– Operating nine Centres of Excellence

– Providing financial support of up to Rs 20 crore per project

“This is the first time recycling has been institutionally embedded in India’s mineral governance framework,” Agnihotri remarked.

**Global Alignment**

Dr. Rachana Arora (GIZ India) noted that India’s policy direction aligns with global trends, particularly EU strategies regarding battery supply chains, renewable technologies, and electronics recycling. She underscored the growing cooperation between India and Germany in exploration, processing, and circular economy technologies.

**Technology Readiness**

Dr. Alok Ranjan Paital (CSIR–CSMCRI) stated:

– Hydrometallurgy remains central

– Direct cathode-to-cathode regeneration offers future efficiency

– Technology scale-up is now feasible with backing from policy

**Industry Response**

Vijay Pareek, Executive Director of Gravita India, expressed that the scheme finally provides regulatory clarity, investment confidence, and formalization of the recycling sector. “This policy stability will attract significant capital for scrap-based mineral recovery,” he added.

**Awards & Industry Recognition**

At IMRC 2026:

– **Ardee Industries Ltd** – Recycler of the Year (MSME)

– **Gravita India Ltd** – Recycler of the Year (Large-scale)

**Policy Takeaway**

Since September 2025, the government has notified the scheme guidelines, opened applications until April 2026, established Centres of Excellence, and expanded international cooperation. Together, these measures signal a strategic shift in India’s mineral policy—from extraction-driven security to recycling-led sovereignty.