₹900 crore in one year. That’s what Maharashtra paid in 2024–25 to service World Bank loans. Our investigation reveals why interest and hidden fees make these loans a financial trap.

X: @vivekbhavsar

Part 1 – Intro & Background

When the Government of Maharashtra turned to the World Bank at the turn of the millennium, the promise was straightforward: long-term, low-interest loans to finance critical development projects. From rural water supply schemes to urban transport upgrades, from agricultural competitiveness programs to health sector reforms, World Bank funding was portrayed as a catalyst for growth.

But two decades later, a different picture emerges. Data obtained by TheNews21 through a series of Right to Information (RTI) applications to the Union Ministry of Finance reveals a harsh reality: Maharashtra has been paying far more in interest and hidden fees than what is visible in the headline loan amounts.

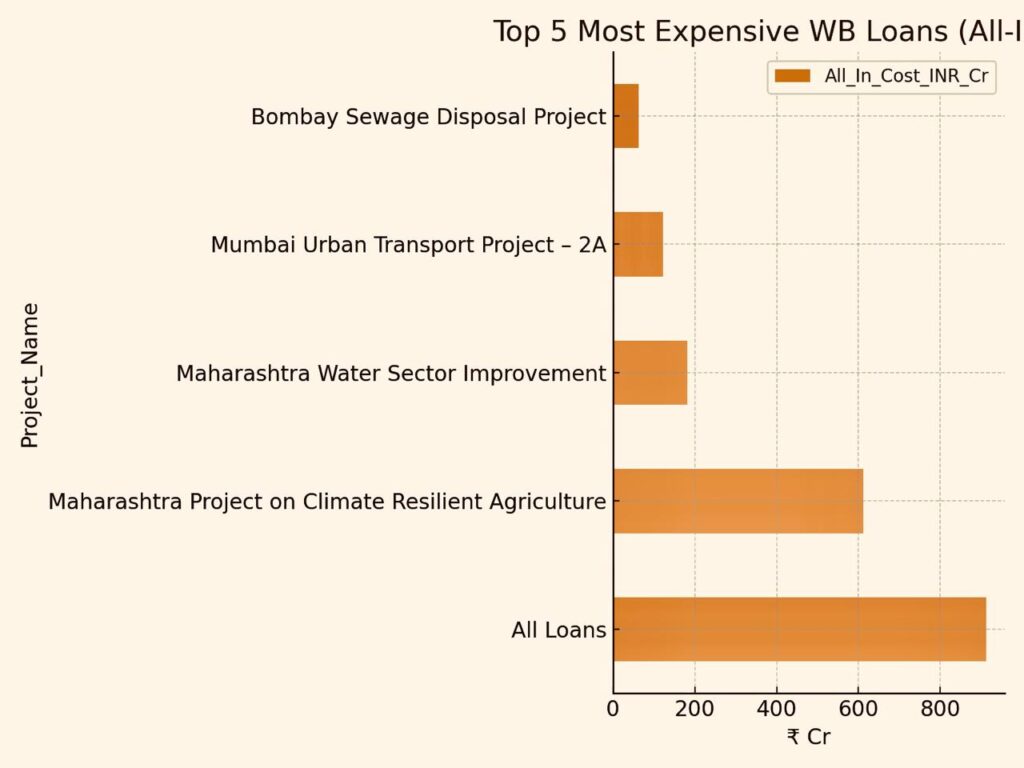

By 2024–25, the state shelled out nearly ₹900 crore in a single year servicing World Bank loans — a burden not just of repaying principal, but also of paying interest charges and “commitment fees” that quietly drain the treasury. In fact, our investigation shows that in several cases, the All-In Cost — principal repayments plus interest plus fees — has overshot the original loan sanction by a staggering margin.

This raises a fundamental policy question: are World Bank loans truly cheaper than borrowing domestically from Indian banks, NABARD, or the bond market? Or has Maharashtra been locked into an expensive borrowing model that benefits multilateral lenders while squeezing taxpayers?

The World Bank Connection

Maharashtra’s borrowing from the World Bank has spanned across critical sectors:

- Water and Sanitation: Jalswarajya project (2003), Rural Water Supply & Sanitation Program (2014).

- Urban Transport: Mumbai Urban Transport Project – MUTP 2A (2010).

- Agriculture & Rural Transformation: Agricultural Competitiveness Project (2010), Climate Resilient Agriculture Project (2018), Agri-Business Transformation (2019).

- Disaster Management & Health: Maharashtra Earthquake Emergency Program (1994), Health Systems Development Project (1999).

Each of these projects came with glossy promises of international expertise, concessional rates, and long repayment schedules. But the fine print — especially the foreign exchange risks, interest margins, and commitment charges — has ensured that Maharashtra keeps paying long after the ribbon-cutting ceremonies are over.

This sets the stage. In Part 2, I’ll take readers directly into the data story: how much Maharashtra has repaid, how interest and fees stack up, and why the “All-In Cost” changes the entire narrative.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.